source: Freepik

Tether has long been the leader in stablecoins globally, with USDT having a market capitalization of over $110 billion. But in 2025, the company made its most ambitious play yet: launching a U.S.-based stablecoin named “USAT”, produced with oversight from American regulators.

Why does it matter? Tether had managed to avoid direct regulatory conflict with U.S. regulators for decades by keeping operations foreign. Now, being under increasing pressure from lawmakers, competition in the form of Circle’s USDC, and new entrants like PayPal USD, Tether is shifting gears. USAT is more than just another stablecoin—Tether’s bid for legitimacy in the most regulated financial system in the world.

Why Tether Introduced USAT

source: SUPRA

It is no accident that Tether opted for this. Rather, it is a point of intersection between market forces and regulatory conditions:

- Regulatory Pressure: The United States has been cracking down on stablecoins increasingly, with the need for greater transparency and regulation. Tether’s release of USAT indicates it is ready to evolve.

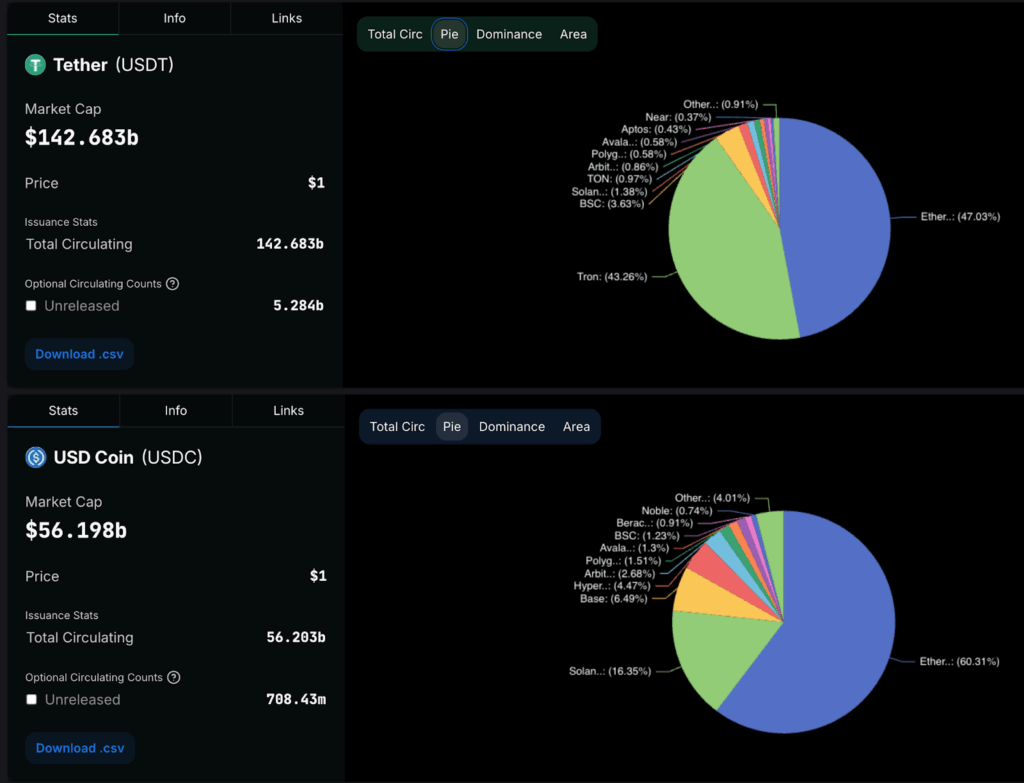

- Competitive Threats: USDC backed by Coinbase, a U.S.-compliant stablecoin, has emerged as the “safe” institutional stablecoin. PayPal USD is fast expanding in trade and payment. Tether can become irrelevant without a regulated U.S. product.

- Institutional Adoption: A regulated U.S. stablecoin brings the possibility of collaboration with payment providers, fintechs, and banks that will never even come near USDT because of compliance.

The Regulatory Environment: Balancing Acts

source: CoinGape

That USAT is coming is an immediate question: Will U.S. regulators accept or shut it out to oblivion?

- Possible Regulation: The SEC and FinCEN regulators could treat USAT as a security or apply strict AML/KYC regulations.

- Compliance Plus: By being in sync with U.S. systems, USAT could grow more quickly than its offshore sibling, USDT. That would make it a favorite among institutional investors.

- Transparency Mandates: Tether has previously been charged with insufficient proof of reserves. Under U.S. regulation, it could be required to provide audited statements and periodic disclosure.

The danger is apparent: increased legitimacy, decreased flexibility. Tether’s appeal stems from its velocity and lack of strict oversight—qualities that won’t prove so enduring in a U.S.-regulated market.

Market Reaction: Investor Anticipation or Suspicion?

The crypto market has reacted carefully to USAT’s debut:

- Institutional Breakthrough: Others consider this a breakthrough. Banks and fintechs would now be able to onboard a Tether-backed stablecoin without regulatory warning signs.

- Retail Clutter: To retail traders, USAT is “just another coin” with USDT, USDC, and PayPal USD. The question is: why switch?

- Liquidity Shifts: Initial numbers show tiny but real flows of capital from USDT to USAT, especially on U.S.-friendly exchanges. This could grow if U.S. institutions get it on board in quantity.

Future Outlook: Can USAT Revolutionize Stablecoins?

Much hangs in the future for Tether:

- Best-Case Scenario: USAT is the “Wall Street-approved” stablecoin, winning regulator trust and a position in mainstream finance.

- Worst-Case Scenario: Overcompliance burden + innovation lag erodes Tether’s market leadership, allowing Circle or PayPal an opportunity to take over market leadership.

- Ripple Effect: If successful, USAT could lead other stablecoin issuers globally to develop region-specific, compliant versions—opening up a new era of “regulated stablecoins.”