source: CryptoRank

When the U.S. Federal Reserve signals that it will reduce interest rates, markets ranging from equities and bonds to commodities react — and so does Bitcoin. As inflation pressures ease, the speculation grows: Will the Fed reduce rates sooner rather than later, and what effect will it have on the price of Bitcoin? History suggests that rate cuts have traditionally preceded periods of increased risk-appetite, which could drive crypto inflows. Yet the correlation is not always linear: timing, macroeconomic backdrop, and market sentiment are all relevant. This article discusses how previous Fed rate reductions have affected Bitcoin, what traders look out for in terms of signals, and what may transpire over the next few months.

1. The Link Between Interest Rates and Bitcoin

- Opportunity cost & cost of capital: Decreasing interest rates reduce the return on risk-free assets (savings, bonds), making non-yielding assets such as Bitcoin attractive.

- Inflation outlook: Rate cuts are seen after inflation eases or the economy decelerates. If investors believe inflation will remain elevated, Bitcoin can surge as a hedge; otherwise, markets will prefer fiat assets.

- Multiple confounding factors: Rate cuts happen to go with economic shocks, recessions, or easing credit conditions, which themselves may drive or dampen demand for crypto.

2. Historical Case Studies

A. 2019 Rate Cuts & Pre-COVID Era

In mid-2019, the Fed reduced rates three times. Bitcoin first rallied as investors reacted to global uncertainty and decreased dollar strength. The rally was muted but persistent.

B. 2020 Rate Cuts Amid COVID Crisis

Aggressive rate reductions and liquidity injection in emergency mode in March 2020 spurred risk assets. Volatility was seen by Bitcoin — a sudden dip during panic selling and thereafter a strong recovery as risk appetite improved once again.

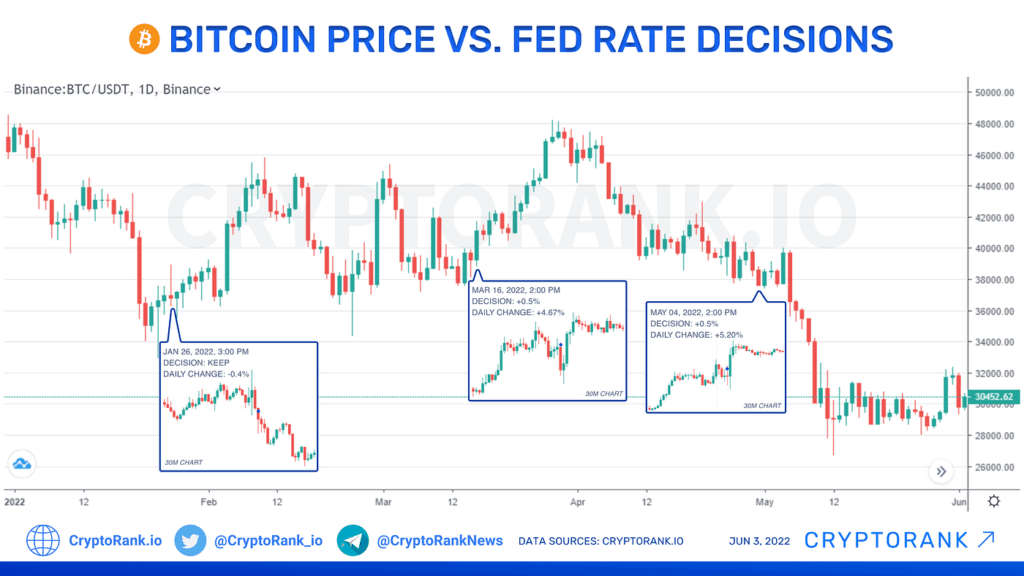

C. 2022-2023 Tightening & Cuts Signals

Bitcoin declined as the rate hikes were most aggressive. But since the Fed was about to turn around and there were indications that there would be future cuts, the speculative bets increased, and this caused short-term rallies. These kinds of rallies are very much expectation-driven and not driven by actual cuts.

3. Recent Signals & What They Tell Us Now

source: CoinDesk

4. What Investors Should Be Looking Out For

- Fed forward guidance: commentary on the rate path more significant than the cuts themselves.

- Inflation surprises: CPI, PCE inflation data releases.

- Bond yields & DXY (Dollar Index): they move very quickly and tend to be a precursor to Bitcoin moves.

- Market liquidity: rate reductions will provide liquidity; tight credit regimes can dampen that impact.

5. Risks of Assuming a Simple Bounce

- Policy decision to market response lag: there tends to be lag, and other macro factors will step in (geopolitics, crackdowns by regulators).

- Priced-in expectations: if cuts are already priced in, real cuts can be followed by “sell the news” behavior.

- Risk of reacceleration of inflation: if inflation returns, Fed can pivot, hurting risk assets like Bitcoin.