For decades, gold has reigned supreme as the ultimate safe-haven asset — a hedge against inflation, currency devaluation, and geopolitical uncertainty.

Yet, as global markets adapt to digital finance, Bitcoin (BTC) is increasingly challenging that throne.

In 2025, investor behavior is revealing a striking trend: capital flows into Bitcoin are beginning to mirror — and in some cases, outpace — gold. The rise of Bitcoin ETFs, shifting interest rate policies, and the generational wealth transfer to digital-native investors are all converging to reshape how the world defines “value.”

1. The Historical Context: From Gold Bars to Digital Blocks

Gold’s role as a store of value spans millennia — its scarcity, divisibility, and universal recognition have made it the cornerstone of wealth preservation.

Bitcoin, born in 2009, shares many of those same principles — scarcity (21 million cap), verifiability, and independence from central banks — but with one crucial difference: it’s borderless and programmable.

2. Investor Flows Reveal Changing Preferences

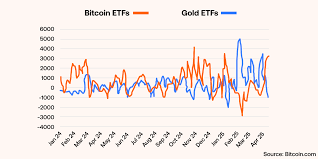

According to recent data from CoinShares and Bloomberg Intelligence, Bitcoin investment products — primarily spot Bitcoin ETFs — have attracted more than $5.9 billion in inflows during Q3 2025 alone.

In comparison, gold ETFs saw a net outflow of nearly $1.2 billion, signaling that institutional investors are reallocating part of their safe-haven exposure from physical to digital assets.

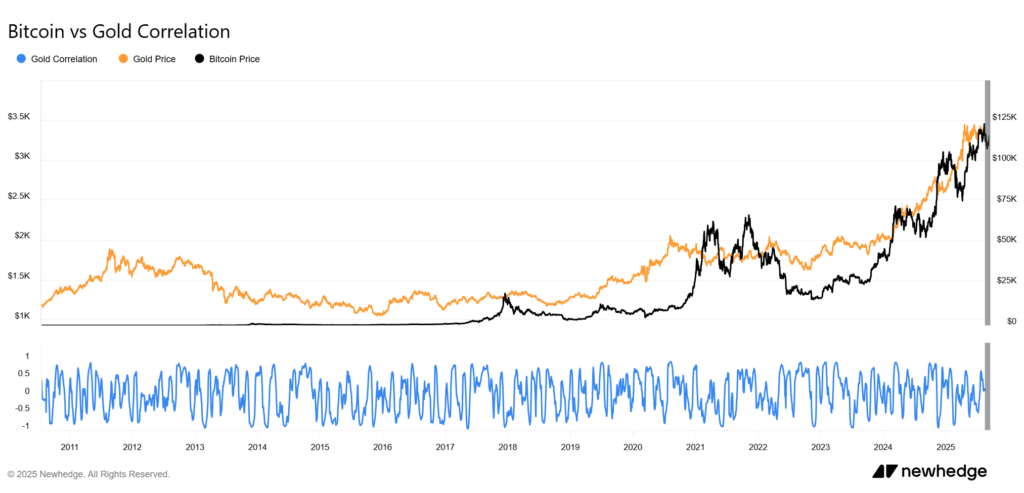

This marks a fundamental shift in portfolio diversification strategy: Bitcoin is no longer seen solely as a speculative asset but as a macro hedge alongside traditional safe-havens.

3. Macro Drivers: Rate Cuts, Inflation, and Dollar Weakness

The Federal Reserve’s 2025 rate cuts have triggered a renewed appetite for risk assets — yet Bitcoin’s rally isn’t simply speculative.

Investors are increasingly viewing BTC as a hedge against fiat debasement and long-term inflation, much like gold once was.

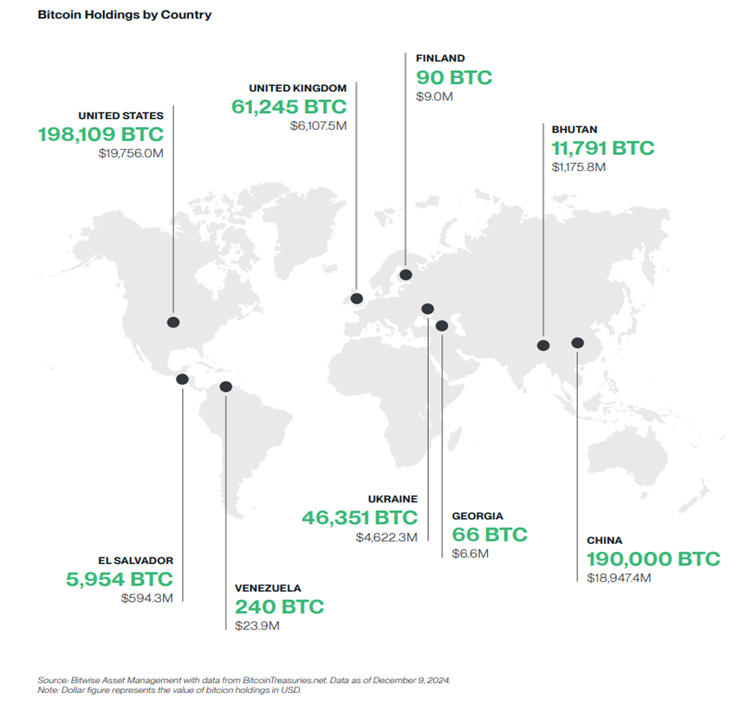

However, Bitcoin also benefits from its limited supply and programmability, attracting both institutional allocators and corporate treasuries seeking diversification beyond traditional assets.

In contrast, gold’s price performance has been more muted, weighed by ETF redemptions and a stronger USD in early 2025 before tapering later in the year.

4. Institutional Sentiment and Market Behavior

Major financial institutions — from BlackRock to Fidelity — have integrated Bitcoin exposure into their multi-asset portfolios.

A 2025 Goldman Sachs survey found that 64% of institutional respondents consider Bitcoin a long-term store of value, compared to 51% in 2023.

At the same time, gold remains deeply entrenched among sovereign wealth funds and conservative pension schemes, meaning the two assets may coexist rather than compete.

The narrative is evolving toward a dual-safe-haven model, where both assets serve complementary purposes:

- Gold for tangible, physical value retention.

- Bitcoin for digital liquidity and cross-border mobility.

5. The Outlook: From Competition to Convergence

By 2030, analysts at JP Morgan and ARK Invest predict Bitcoin could capture 10–15% of gold’s total market cap, translating into a BTC price above $250,000.

But the long-term story isn’t only about price — it’s about trust migration.

As younger generations inherit wealth, their comfort with digital assets may make Bitcoin the default safe-haven of the digital era, coexisting with — rather than replacing — gold.

Conclusion

The battle between Bitcoin and gold is not a zero-sum game; it’s the evolution of human trust in what holds value.

In a world where code is replacing coin and transparency outpaces tradition, investors are rewriting centuries-old narratives.

Both assets tell the same story — only in different languages:

gold speaks in weight; Bitcoin, in data.